texas travel nurse taxes

Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses. To be eligible to receive tax-free stipends travel nurses have to meet several conditions and requirements.

Lpn Travel Nurse Salary Comparably

Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage.

. The general rule is. First your home state will tax all income earned everywhere regardless of source. This is especially true for those of you who are new to travel nursing.

Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other. You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable. The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs.

Travel nurse file exempt for various reasons. 20 per hour taxable base rate that is reported to the IRS. Those periods in life are understandable but there are other reasons travelers file exempt that do not benefit in the long haul especially when there is an amount is owed with the annual tax return.

Keeping clear records of your expenses with receipts is a great way to ensure that you file your taxes accurately. A travel nurse needs two housing expenses while they travel to get tax-free reimbursements. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. Having a professional help you with filing your taxes is always a smart decision. Then you can have an RV that you will pay to park close to your assignment in.

Travel nurse tax deductions include living expenses such as housing stipends housing reimbursements and meals. This illustrates that the total value of the contract with taxed and untaxed income. Unfortunately you can only receive the tax-free stipend option if you can claim a permanent tax-home.

5 Tax Tips for Travel Nurses. Tax-Free Stipends for Housing Meals Incidentals. This is the most common Tax Questions of Travel Nurses we receive all year.

For example they might estimate that the tax burden will be 20. Keep a notebook of your spending and mileage. These specialists can help you figure out your expenses and deductions and ensure that you are following all laws and regulations.

Work with a professional. RNs can earn up to 2300 per week as a travel nurse. While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage.

They will then multiply the gross weekly taxable wage by 20 to determine the estimated tax burden. To accomplish this many recruiters and travel nurses will rely on a ball-park tax rate figure. 2020 TAX GUIDE FOR TRAVEL NURSES 2 2020 is a year like weve never seen before.

You file a non-resident state return for the state you worked in and pay tax to that state. Texas Washington and Wyoming do not have income tax. FREE YEARLY TAX ORGANIZER WORKSHEET.

Travel nurse earnings can have a tax advantage. A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. In addition to these tips we recommend that you research in-depth any new changes to the tax laws and that you hire a qualified CPA to help you.

First you have a tax home. FEDERAL AND STATE TAX PREPARATION. I could spend a long time on this but here is the 3-sentence definition.

There are two ways you can be paid as a travel nurse. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. If you took on a travel nursing assignment nearby and youre not actually working away from home or incurring additional expenses the stipends count as taxable wages rather than tax-free stipends.

FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. Not just at tax time. 5 Tax Filing Tips for Travel Nurses.

These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. Under the effects of the COVID-19 outbreak the healthcare world is facing unprecedented. Then add taxed and untaxed.

July 9 2020 529 AM. For more on travel. The most common is to bolster take-home pay during a financial hardship.

Or are paid a fully taxable hourly wage taxed on the total rate of pay. Here is an example of a typical pay package. Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below.

Your report all your income on your home state return even the income earned out of state. These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. In this case it is 25720 before taxes or 5495hour.

From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to know about travel nurse taxes. The fact that the income was not earned in the home state is irrelevant. This means travel nurses can no longer deduct travel-related expenses such as food mileage gas and license fees and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually.

Your home state will give you a credit or partial credit for what you paid the non-resident state. Travel Nurse Tax Deduction 1. This makes it very easy to compare two contracts total value.

This is how a lot of travel nurses handle taxes. You first need to follow the tax home rules to make sure that the first home is set up to be legally considered your tax home. While higher earning potential in addition to tax advantages are a no.

It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Travel expenses such as mileage parking and gas. 250 per week for meals and incidentals non-taxable.

1 A tax home is your main area not state of work. Two basic principles are at work here. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses.

Travel away from home. At the same time the work state will. Typically there are stipends or reimbursements for travel nurses.

Travel RNs may be able to deduct certain nontaxable items from their annual tax filing.

Texas Travel Nurse Pcu Ccu Progressive Care Critical Care Travel Nursing Texas Travel Nurse

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Medical Travel Travel Nursing Nursing School Prerequisites Nursing School Tips

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

How To Become A Travel Nurse Salary Requirements

State Tax Questions American Traveler

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Infographic Travel Nursing Careers Choosing A Healthcare Staffing Agency Travel Nursing Travel Nursing Agencies Nurse

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

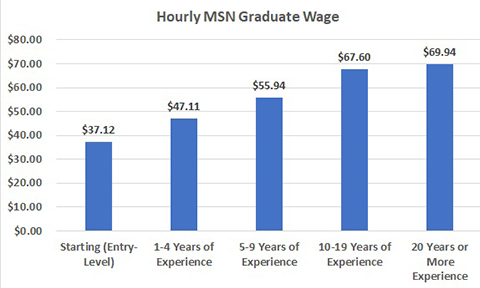

Master Of Science In Nursing Msn Salary 2022

States With Highest And Lowest Sales Tax Rates

How Often Do Travel Nurses Get Audited Tns

How Much Do Travel Nurses Make Factors That Stack On The Cash

Trusted Guide To Travel Nurse Taxes Trusted Health

How To Make The Most Money As A Travel Nurse

All You Need To Know About Travel Nursing In The Us Infographic Travel Nursing Nursing Tips Nursing Programs